In the global push for renewable energy, it is often assumed that larger financial investments directly lead to greater job creation and better environmental outcomes. This project was designed to test that fundamental assumption through a rigorous statistical analysis of over 15,000 renewable energy project records.

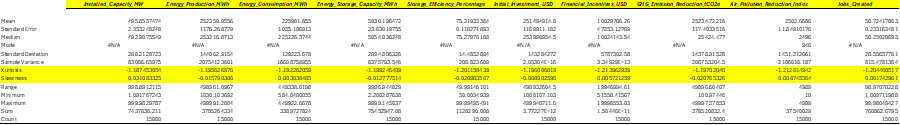

Using the advanced analytical capabilities of Microsoft Excel, including the Data Analysis ToolPak, I performed a series of hypothesis tests to examine the relationships between funding, project type, and key performance indicators. The results were surprising: the analysis found no significant statistical link between investment levels and their expected impacts, providing a crucial, data-driven insight for policymakers and investors.

Key Research Questions:

- Investment Efficacy: Does higher funding automatically translate to better project outcomes?

- Job Creation Hypothesis: Can we statistically prove that investment levels directly correlate with employment generation?

- Policy Implications: What factors should policymakers prioritize beyond capital allocation?

- Strategic Resource Allocation: How can governments and investors maximize economic and environmental impact?

Strategic Significance:

This analysis challenges fundamental assumptions in renewable energy policy, providing evidence-based insights that can prevent misguided investments and guide more effective resource allocation strategies. The findings demonstrate that correlation does not equal causation, and sometimes, there isn't even a correlation.